Here’s a no-cost way to complete gen eds. Get details

Bachelor of Science in Accounting

PROGRAM AT A GLANCE

Take the next step in accounting

Advance your skills in accounting with a Bachelor of Science in Accounting from Strayer University. We start with fundamentals, procedures and laws, and move quickly to more advanced concepts using real-world examples that help you apply what you’re learning.

Skills to set you apart

In this program, you’ll study all aspects of financial accounting, from basic payables and receivables to complex tax codes and accounting for multinational operations. You’ll also develop management and leadership skills to become a champion for financial accountability in your organization.

Build your skills

- Analyze the theoretical concepts related to U.S. and International accounting principles so that practices may be applied within the accounting function of an organization including for profit, governmental and not-for-profit entities.

- Demonstrate an understanding of business functions within an organization to align accounting systems with the information requirements of an organization.

- Apply relevant taxation theory and practices within an organization to ensure compliance with federal and state regulations.

- Analyze the process for auditing an organization’s processes and practices to ensure strong internal controls for the safeguarding of assets.

- Demonstrate the ability to analyze accounting information, comprehend its value, uses and limitations, and communicate the information effectively to management.

- Prepare, analyze and interpret internal managerial accounting data and reports to make relevant business decisions.

- Develop ethical decision-making abilities that support business practices, policies, procedures and integrity within an organization.

Accredited online university

Strayer University has distinct accreditations and affiliations that attest to our academic quality. We're committed to meeting quality standards, so you can earn a diploma you're proud to display. View the ACBSP student achievement information.

Features

Save on your degree

For every three classes you pass, you’ll earn one on us at the end of your program. Eligibility and participation rules apply.

SHRM-CP Preparation Course

Enroll in the SHRM-CP Preparation Course to learn the skills needed to take the SHRM-CP exam and gain knowledge in the competencies required, including people, organizations and the workplace. Alternatively, you could take the Human Resource Management Capstone course.

85

of Strayer bachelor’s alumni agree that Strayer was the right choice for earning their degree.

Strayer Alumni Survey, 2023

Bachelor of Science in Accounting cost breakdown

- 40 courses, $1555 per course

- $65 technology fee each term

- $150 one-time degree conferral fee

- $100 resource kit per course

Estimate the cost of your degree

How much can I save on a Bachelor of Science in Accounting?

Estimate the cost of your degree

How much can I save on a Bachelor of Science in Accounting?

Expected Graduation

...

Approximate Total

...

*Student is required to take two courses per quarter during disbursement period

PREPARING YOUR RESULTS

Time commitment

Calculate the approximate time commitment of your degree.

| Course load | ... courses/term |

| Classroom time | ... hours/week |

| Terms per year | ... terms |

| Terms to graduation | ... terms |

Cost analysis

Calculate the approximate cost of your degree

| Tuition | ... |

| Books | ... |

| Fees | ... |

| No-cost gen ed | $0 |

| Transfer credits | ... |

| Transfer Credit Scholarship | $0 |

| $4K scholarship | $0 |

| Strayer Learn and Earn Scholarship | $0 |

| Approximate total | ... |

Ways to reduce tuition

Employer Tuition Assistance

More than 500 organizations invest in their employees by partnering with Strayer University to offer access to discounted education programs.

The Strayer Learn and Earn Scholarship

For every three courses you pass, earn one on us, tuition-free, to be redeemed at the end of your program with the Strayer Earn and Learn Scholarship. Eligibility rules and restrictions apply. Connect with us for details.

Save up to $15,250 on your bachelor’s degree

As a Strayer student, you have access to no-cost gen ed courses through our affiliate, Sophia. Take up to two online Sophia courses at a time and transfer eligible courses towards your undergraduate degree.

*Savings assumes transferring 10 courses taken at Sophia. Eligibility rules apply. Connect with us for details.

What you’ll learn in Strayer’s Bachelor of Science in Accounting program

Examine the foundations of accounting practice and prepare to pursue career opportunities in the field. Strayer’s Bachelor of Science (BS) in Accounting introduces you to foundational accounting principles and then advances to intermediate and advanced courses. You’ll also examine government and not-for-profit accounting and federal taxation. Through a collaborative workplace learning course, you’ll gain hands-on experience. Plus, a strong liberal arts component will help you develop the communication and critical thinking skills employers value.

BS in Accounting program requirements

- 81 credit hours in major BS in Accounting courses

- 67.5 credit hours in general education courses

- 31.5 credit hours in elective courses of your choosing

Convenient online learning

At Strayer, our online programs give you the flexibility to earn your degree from just about anywhere there’s reliable internet access – day or night. Through our online portal, you’ll be able to:

- Watch lectures and complete coursework

- Submit assignments and take exams

- Communicate with professors and classmates

- Access student resources and support

How long will it take to earn a Bachelor of Science in Accounting?

- There are 40 courses, each 11 weeks long.

- How many courses you take per term and eligible transfer credits from an accredited institution (if applicable) will determine how long the overall program will be.

- Strayer University credits are expressed in quarter hours.

- One quarter hour of credit is granted for the successful completion of 10 contact hours per course.

- The standard requirement for one course is for students to spend 13.5 hours in weekly work, both in and outside of the classroom. For each week of a quarter, one hour of classroom or online course activity and a minimum of two hours of outside study/preparation time per credit hour are built into the design of each course. Strayer’s course design uses this requirement to meet applicable regulatory standards. This includes preparation, activities and evaluation over 10 weeks for a total of 135 hours of student work.

What can you do with a BS in Accounting?

Your education can help you pursue your professional and personal goals. While Strayer cannot guarantee that a graduate will secure any specific career outcome, such as a job title, promotion or salary increase, we encourage you to explore the potential impact you can have in the accounting field.

Versatile skills for your future

The accounting concentration can help you learn to make better-informed business decisions. You’ll explore all aspects of financial accounting, from basic payables and receivables to complex tax codes and accounting for multinational operations.

In addition, students who complete this concentration will be prepared to:

- Calculate interest charges, balances due, discounts, equity and principal.

- Use ledgers or computers to classify, document and summarize financial data.

- Leverage specialized accounting software to create, maintain and interpret spreadsheets and databases.

- Prepare reports around cash receipts, expenditures, payables and receivables, and overall profits and losses.

- Obtain, process, analyze and evaluate financial information from relevant sources.

- Use relevant information to help ensure processes comply with laws, regulations and standards.

- Find and report financial discrepancies.

- Confirm accuracy of financial or transactional information.

87

of alumni agree that they would recommend Strayer to others.

Strayer Alumni Survey, 2023

How to apply for a bachelor’s degree at Strayer?

An admissions officer can help you choose the right program, register for classes, transfer credits and find cost-savings opportunities.

Here’s what you’ll need to get started:

A completed application and enrollment agreement

A high school diploma or equivalent

Official transcripts from all colleges or universities attended

A valid, current and legible government-issued photo ID

Spring classes start on April 6

Learn more about Strayer University’s admissions process.

Transferring to Strayer from another university?

Your bachelor’s degree from Strayer could be 70% complete when you transfer up to 28 classes.

Strayer welcomes international students

Strayer University is proud to have hosted more than 4,000 international students from over 143 countries. Earn your degree in the U.S. or completely online in your home country – it’s your choice.

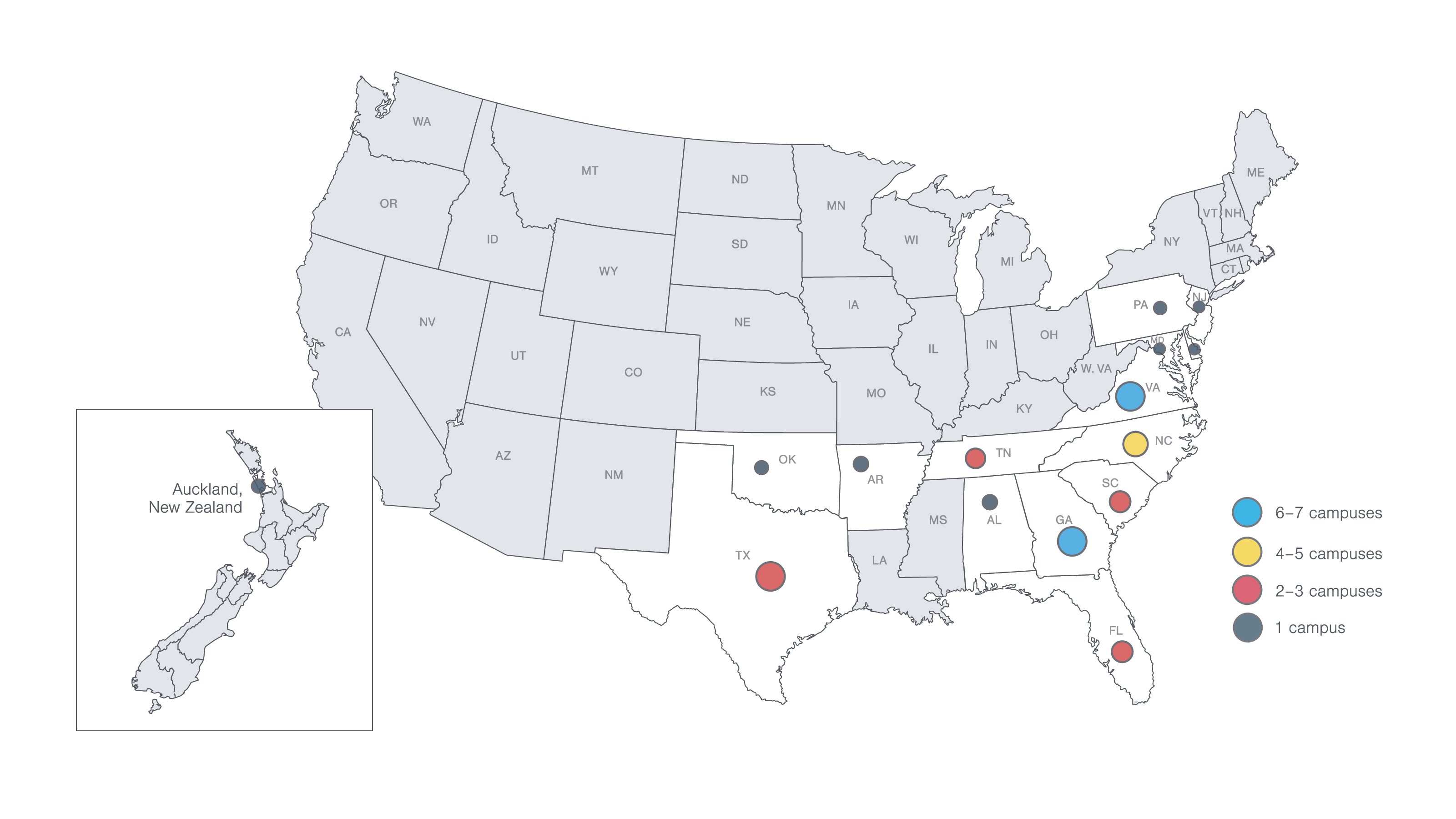

Campus locations

Come to a campus near you for guidance and support. You’ll have access to helpful resources, a supportive community and plenty of spaces to learn and grow.

Ready to take the next step?

Your admissions officer is here to guide you through every step of the process, from completing your application to choosing your concentration.