Here’s a no-cost way to complete gen eds. Get details

Bachelor of Business Administration Finance

PROGRAM AT A GLANCE

40 bachelor's courses

11 weeks long

$ 1555

Cost per course

Flexible learning

Online and in-person programs at select campuses, subject to availability

Why earn a degree in finance from Strayer?

Strayer’s Bachelor of Business Administration (BBA) with a Finance concentration introduces you to key financial concepts and institutions. You’ll also explore the application of corporate finance in real business settings.

Fuel business growth and financial stability

Learn how key financial concepts are applied in business settings with a Bachelor of Business Administration (BBA) in Finance from Strayer. You’ll build your understanding of regulatory environments, risk assessment, competing investment evaluation and other analysis and reporting skills.

Skills you’ll learn in a Strayer BBA, Finance concentration

A Strayer degree can help prepare you for career opportunities in a finance-related field while offering support, flexible learning options and career planning every step of the way.

- Work with corporate finance tools and techniques that enable effective financial management.

- Analyze and evaluate financial performance and investment strategies.

- Differentiate between the risks, costs and availability of methods used to acquire funds.

- Measure the risk and return associated with various asset alternatives and choose between competing investment options.

- Understand the regulatory environment in which financial managers must operate.

Earn your degree from an accredited university

Strayer University has distinct accreditations and affiliations that attest to our academic quality. We’re committed to meeting quality standards, so you can earn a diploma you’re proud to display.

Our business degree programs are programmatically accredited by the Accreditation Council for Business Schools and Programs. View the ACBSP student achievement information.

Strayer University is an accredited institution and a member of the Middle States Commission on Higher Education (MSCHE or the Commission) www.msche.org. Strayer University’s accreditation status is Accreditation Reaffirmed. The Commission’s most recent action on the institution’s accreditation status on June 22, 2017 was to reaffirm accreditation. MSCHE is recognized by the U.S. Secretary of Education to conduct accreditation and pre-accreditation (candidate status) activities for institutions of higher education including distance, correspondence education, and direct assessment programs offered at those institutions. The Commission’s geographic area of accrediting activities is throughout the United States.

Bachelor of Business Administration in Finance cost breakdown

- 40 courses, $1555 per course

- $65 technology fee each term

- $150 one-time degree conferral fee

- $100 resource kit per course

Estimate the cost of your degree

How much does a Bachelor of Business Administration in Finance cost?

Estimate the cost of your degree

How much does a Bachelor of Business Administration in Finance cost?

Expected Graduation

...

Approximate Total

...

*Student is required to take two courses per quarter during disbursement period

PREPARING YOUR RESULTS

Time commitment

Calculate the approximate time commitment of your degree.

| Course load | ... courses/term |

| Classroom time | ... hours/week |

| Terms per year | ... terms |

| Terms to graduation | ... terms |

Cost analysis

Calculate the approximate cost of your degree

| Tuition | ... |

| Books | ... |

| Fees | ... |

| No-cost gen ed | $0 |

| Transfer credits | ... |

| Transfer Credit Scholarship | $0 |

| $4K scholarship | $0 |

| Strayer Learn and Earn Scholarship | $0 |

| Approximate total | ... |

Opportunities to save on tuition

Employer Tuition Assistance

More than 500 organizations invest in their employees by partnering with Strayer University to offer access to discounted education programs.

The Strayer Learn and Earn Scholarship

For every three courses you pass, earn one on us, tuition-free, to be redeemed at the end of your program with the Strayer Earn and Learn Scholarship. Eligibility rules and restrictions apply. Connect with us for details.

Save up to $15,250 on your bachelor’s degree

As a Strayer student, you have access to no-cost gen ed courses through our affiliate, Sophia. Take up to two online Sophia courses at a time and transfer eligible courses towards your undergraduate degree.

*Savings assumes transferring 10 courses taken at Sophia. Eligibility rules apply. Connect with us for details.

Explore courses in Strayer’s Bachelor of Business Administration, Finance

Are you fascinated by how money moves and grows? Gain a deeper understanding of the core ideas and real-world practices behind financial decisions in Strayer University’s finance concentration. You’ll explore the vital role financial institutions play, learn about various sources of capital and analyze how funds are spent. The program also examines financial tools used to evaluate investment opportunities, understanding the rewards and risks involved across various financial markets.

Finance concentration courses

Complete your degree from where you live, on your time, in a flexible, 100% online program. Using our online portal, you’ll be able to:

- Access lectures and coursework

- Complete assignments and exams

- Communicate with professors and classmates

- Access student resources and support

From day one, you’ll have a team of advisors and coaches to help you balance college, work and your personal life. Tap into support resources online or at a campus near you.

You’ll have access to:

- Admissions and enrollment support

- One-on-one academic coaches

- Financial guidance and potential cost savings

- Career planning services

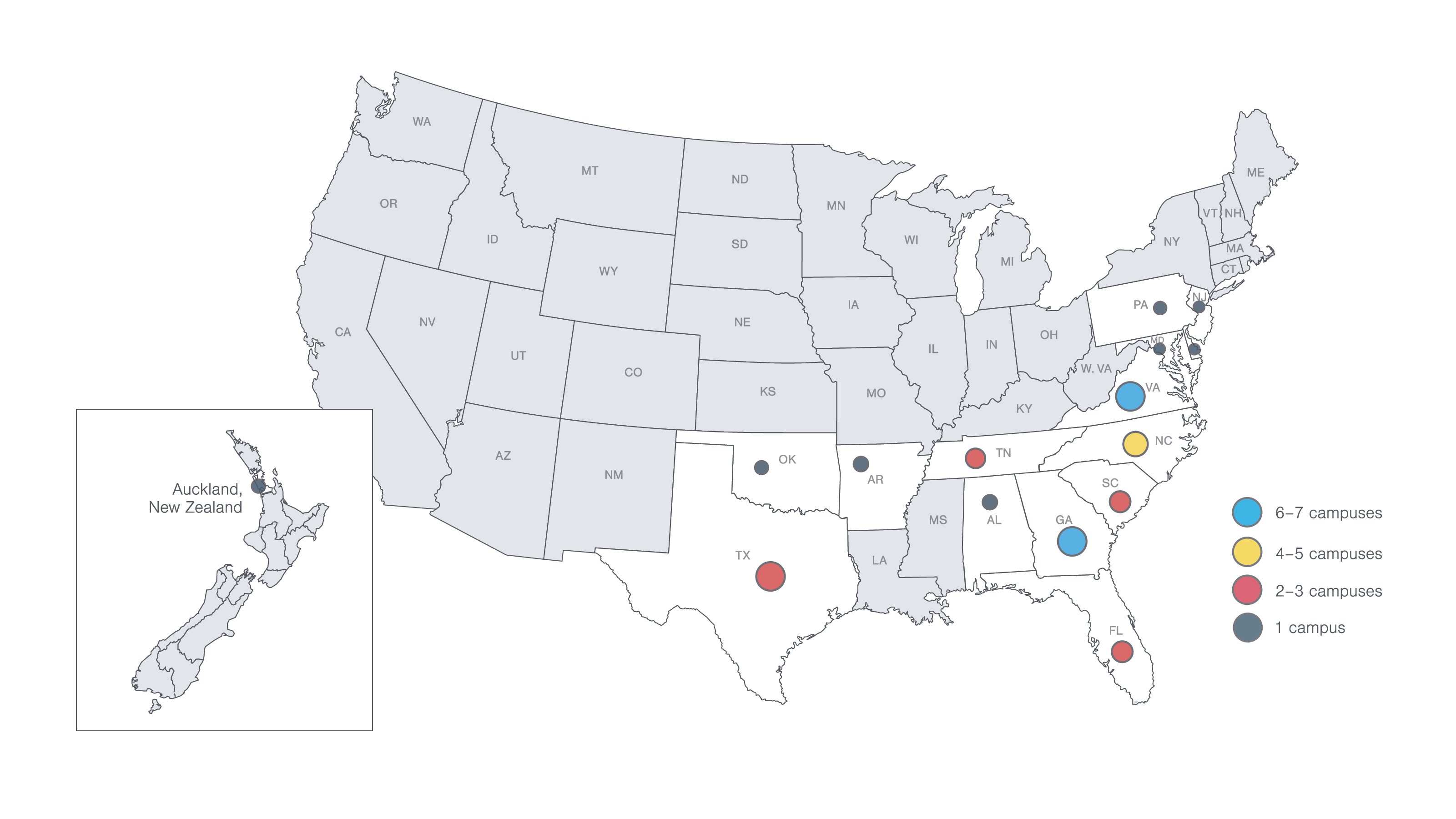

Strayer has many campuses where you can connect with your peers, chat with student coaches, access support resources and attend in-person hybrid classes (at select campuses only).

The faculty at Strayer University bring years of real-world industry experience to the classroom, offering valuable insight and practical knowledge. They are committed to supporting your professional goals and are responsive to questions and concerns through the virtual courseroom.

What can you do with a BBA in Finance?

Your education can help you pursue your professional and personal goals. While Strayer cannot guarantee that a graduate will secure any specific career outcome, such as a job title, promotion or salary increase, we encourage you to explore the potential impact you can have in the finance field.

Versatile skills for your future

The Finance concentration develops student knowledge of theory and practice of financial decision making. Students will learn the role/risk of the financial institution and the sources and uses of funds. Students will be prepared to use financial tools to analyze investment risk and rewards in a variety of financial markets.

In addition, students who complete this concentration will be prepared to:

- Analyze potential risks, investments and market conditions to prepare reports for management.

- Communicate with investors to update them with financial information or to get funding.

- Create financial and regulatory reports that are required by laws, regulations or boards of directors.

- Develop connections with customers and help resolve any issues that they may encounter.

- Evaluate loan and credit applications in order to approve or reject them.

- Interview, hire and train new employees.

- Lead negotiations with insurance providers, choose brokers or carriers, and arrange insurance coverage.

- Monitor and manage the movement of cash or financial instruments, like stocks, bonds and more.

- Plan budgets and assess the current and future financial status of companies.

- Recommend ways to improve an organization’s financial systems, procedures and investments.

- Report past-due accounts for collection and review collection reports for outstanding balances.

- Supervise and organize tasks for employees working in different company branches, offices or departments such as branch banks, brokerage firms or credit departments.

Apply for your Finance degree today

An admissions officer can help you choose the right program, register for classes, transfer credits and find cost-savings opportunities.

Here’s what you’ll need to get started:

Spring classes start on April 6

Learn more about Strayer University’s admissions process.

Transferring to Strayer from another university?

Your bachelor’s degree from Strayer could be 70% complete when you transfer up to 28 classes.

Strayer welcomes international students

Strayer University is proud to have hosted more than 4,000 international students from over 110 countries. Earn your degree in the U.S. or completely online in your home country – it’s your choice.

Campus locations

Come to a campus near you for guidance and support. You’ll have access to helpful resources, a supportive community and plenty of spaces to learn and grow.

Ready to take the next step?

Your admissions officer is here to guide you through every step of the process, from completing your application to choosing your concentration.