Here’s a no-cost way to complete gen eds. Get details

Bachelor of Business Administration Accounting

PROGRAM AT A GLANCE

40 bachelor's courses

11 weeks long

$ 1555

Cost per course

Flexible learning

Online and in-person programs at select campuses, subject to availability

Why earn a degree in accounting from Strayer?

Find your path to meeting your personal and professional goals with an online Bachelor of Business Administration (BBA) in Accounting. You’ll learn how to do more than crunch numbers – you’ll learn how to apply them in ways that can help businesses thrive.

Analyze business financials with accounting

Discover the keys to making well-informed financial business decisions with a Bachelor of Business Administration (BBA) in Accounting from Strayer. You’ll learn how to use Excel and QuickBooks to provide accounting information, the basics of evaluating financial statements and how to prepare a personal and corporate federal income tax return. Throughout your program, you’ll build an understanding of concepts like inventory planning, cost distribution and mathematical and statistical models in cost accounting.

Skills you’ll learn in a Strayer BBA, Accounting concentration

A Strayer degree can help prepare you for career opportunities in an accounting-related field while offering support, flexible learning options and career planning every step of the way.

- Understand how to use Excel and QuickBooks to provide accounting information for organizations.

- Demonstrate a comprehensive understanding of fundamental concepts and principles in accounting, including recording of journal entries and preparing and evaluating financial statements.

- Solve general problems relating to both personal and business federal income tax and learn to prepare both a personal and a corporate federal income tax return.

- Demonstrate an understanding of the relationship of accounting information to inventory planning and control, cost distribution and the use of mathematical and statistical models in cost accounting.

Earn professional digital badges

Earn your degree from an accredited university

Strayer University has distinct accreditations and affiliations that attest to our academic quality. We’re committed to meeting quality standards, so you can earn a diploma you’re proud to display.

Our business degree programs are programmatically accredited by the Accreditation Council for Business Schools and Programs. View the ACBSP student achievement information.

Strayer University is an accredited institution and a member of the Middle States Commission on Higher Education (MSCHE or the Commission) www.msche.org. Strayer University’s accreditation status is Accreditation Reaffirmed. The Commission’s most recent action on the institution’s accreditation status on June 22, 2017 was to reaffirm accreditation. MSCHE is recognized by the U.S. Secretary of Education to conduct accreditation and pre-accreditation (candidate status) activities for institutions of higher education including distance, correspondence education, and direct assessment programs offered at those institutions. The Commission’s geographic area of accrediting activities is throughout the United States.

Bachelor of Business Administration in Accounting cost breakdown

- 40 courses, $1555 per course

- $65 technology fee each term

- $150 one-time degree conferral fee

- $100 resource kit per course

Estimate the cost of your degree

How much does a Bachelor of Business Administration in Accounting cost?

Estimate the cost of your degree

How much does a Bachelor of Business Administration in Accounting cost?

Expected Graduation

...

Approximate Total

...

*Student is required to take two courses per quarter during disbursement period

PREPARING YOUR RESULTS

Time commitment

Calculate the approximate time commitment of your degree.

| Course load | ... courses/term |

| Classroom time | ... hours/week |

| Terms per year | ... terms |

| Terms to graduation | ... terms |

Cost analysis

Calculate the approximate cost of your degree

| Tuition | ... |

| Books | ... |

| Fees | ... |

| No-cost gen ed | $0 |

| Transfer credits | ... |

| Transfer Credit Scholarship | $0 |

| $4K scholarship | $0 |

| Strayer Learn and Earn Scholarship | $0 |

| Approximate total | ... |

Opportunities to save on tuition

Employer Tuition Assistance

More than 500 organizations invest in their employees by partnering with Strayer University to offer access to discounted education programs.

The Strayer Learn and Earn Scholarship

For every three courses you pass, earn one on us, tuition-free, to be redeemed at the end of your program with the Strayer Earn and Learn Scholarship. Eligibility rules and restrictions apply. Connect with us for details.

Save up to $15,250 on your bachelor’s degree

As a Strayer student, you have access to no-cost gen ed courses through our affiliate, Sophia. Take up to two online Sophia courses at a time and transfer eligible courses towards your undergraduate degree.

*Savings assumes transferring 10 courses taken at Sophia. Eligibility rules apply. Connect with us for details.

Explore courses in Strayer’s Bachelor of Business Administration, Accounting

Leverage the fiscal insight of accounting data to help business leaders make smart, informed decisions. You’ll gain hands-on experience using software applications to perform accounting functions such as debits and credits. The curriculum covers core topics including cost and price analysis, federal taxation and managerial accounting, preparing you to pursue accounting.

This concentration is available online-only for Arkansas students.

Accounting concentration courses

Complete your degree from where you live, on your time, in a flexible, 100% online program. Using our online portal, you’ll be able to:

- Access lectures and coursework

- Complete assignments and exams

- Communicate with professors and classmates

- Access student resources and support

From day one, you’ll have a team of advisors and coaches to help you balance college, work and your personal life. Tap into support resources online or at a campus near you.

You’ll have access to:

- Admissions and enrollment support

- One-on-one academic coaches

- Financial guidance and potential cost savings

- Career planning services

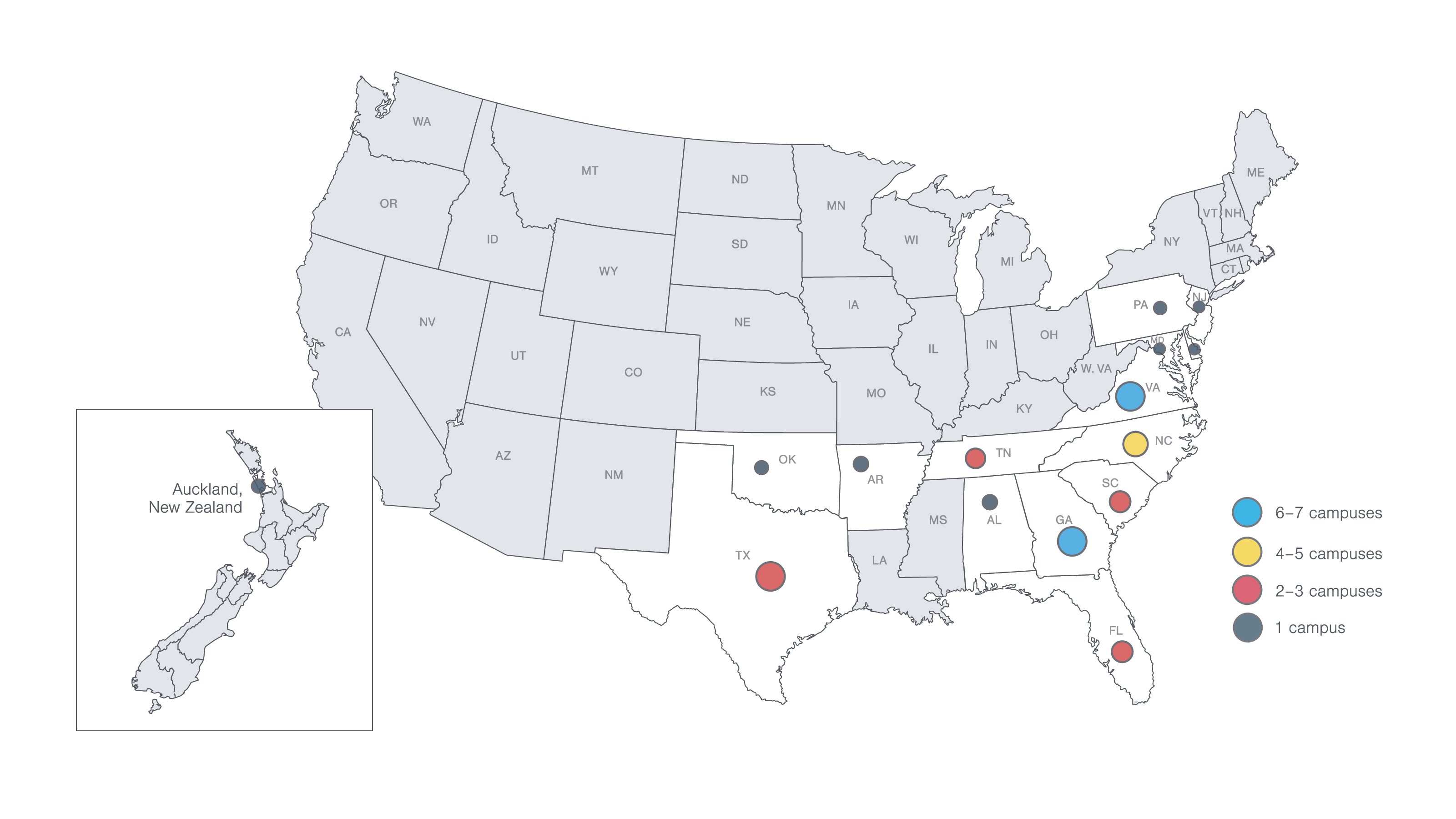

Strayer has many campuses where you can connect with your peers, chat with student coaches, access support resources and attend in-person hybrid classes (at select campuses only).

The faculty at Strayer University bring years of real-world industry experience to the classroom, offering valuable insight and practical knowledge. They are committed to supporting your professional goals and are responsive to questions and concerns through the virtual courseroom.

What can you do with a BBA in Accounting?

Your education can help you pursue your professional and personal goals. While Strayer cannot guarantee that a graduate will secure any specific career outcome, such as a job title, promotion or salary increase, we encourage you to explore the potential impact you can have in the accounting field.

Versatile skills for your future

The Accounting concentration explores accounting principles and procedures. Students will use accounting software applications to perform accounting functions such as debits and credits. Students will specifically focus on federal taxation, managerial accounting and cost and price analysis. Students will learn fundamental accounting knowledge and skills.

In addition, students who complete this concentration will be prepared to:

- Calculate business costs and prepare purchase orders and expense reports.

- Compile different journals and printouts into general ledgers or data processing sheets.

- Complete personal and business tax forms, workers’ compensation forms and other government documents.

- Create and issue bills, invoices, account statements and a variety of other financial statements.

- Create budgeting documents from estimated revenues, expenses and previous budgets.

- Follow federal and state accounting policies, procedures and regulations.

- Generate reports on financial and accounting data, which can include cash receipts, expenses, accounts payable and receivable, and financial performance.

- Manage financial data and accounts using specialized accounting software.

- Perform common accounting office duties like filing, answering phones and interacting with clients.

- Perform financial calculations and produce documents with 10-key calculators, typewriters and copy machines.

- Prepare checks and other forms of payment for bank deposits, taxes, utilities and more.

- Reconcile records to ensure they are accurate and use the correct codes.

Apply for your Accounting degree today

An admissions officer can help you choose the right program, register for classes, transfer credits and find cost-savings opportunities.

Here’s what you’ll need to get started:

Spring classes start on April 6

Learn more about Strayer University’s admissions process.

Transferring to Strayer from another university?

Your bachelor’s degree from Strayer could be 70% complete when you transfer up to 28 classes.

Strayer welcomes international students

Strayer University is proud to have hosted more than 4,000 international students from over 110 countries. Earn your degree in the U.S. or completely online in your home country – it’s your choice.

Campus locations

Come to a campus near you for guidance and support. You’ll have access to helpful resources, a supportive community and plenty of spaces to learn and grow.

Ready to take the next step?

Your admissions officer is here to guide you through every step of the process, from completing your application to choosing your concentration.