Master of Science in Accounting Taxation

PROGRAM AT A GLANCE

Why earn a master’s degree in taxation from Strayer?

Our Master of Science in Accounting, Taxation program can help you gain the skills and knowledge necessary to evaluate and prepare tax documentation to fulfill a specific business need. You’ll learn about individual federal taxation, partnership taxation, the federal income tax structure and applications of income tax accounting.

Master the complexities of tax accounting

Dive deep into the intricacies of tax law and gain specialized accounting skills with a Master of Science (MS) in Accounting, Taxation. Explore the finer points of taxation, including strategic tax planning, audit procedures and advanced tax accounting. You’ll examine the complexities of the federal income tax structure and study key international tax systems. You’ll also evaluate income tax accounting for individuals, proprietorships, corporations and partnerships.

Skills you’ll learn in a Strayer Master of Science in Accounting, Taxation concentration

A Strayer degree can help prepare you for career opportunities in accounting while offering support, flexible learning options and career planning every step of the way.

- Assess the taxation complexities of the federal income tax structure.

- Evaluate income tax accounting for individuals, proprietorships, corporations and partnerships.

- Assess tax requirements for key international tax systems

Earn your degree from an accredited university

Strayer University is an accredited institution and a member of the Middle States Commission on Higher Education (MSCHE or the Commission) www.msche.org. Strayer University’s accreditation status is Accreditation Reaffirmed. The Commission’s most recent action on the institution’s accreditation status on June 22, 2017 was to reaffirm accreditation. MSCHE is recognized by the U.S. Secretary of Education to conduct accreditation and pre-accreditation (candidate status) activities for institutions of higher education including distance, correspondence education, and direct assessment programs offered at those institutions. The Commission’s geographic area of accrediting activities is throughout the United States.

Master of Science in Accounting in Taxation cost breakdown

- 12 courses, $1715 per course

- $65 technology fee each term

- $150 one-time degree conferral fee

- $100 resource kit per course

Estimate the cost of your degree

How much does a Master of Science in Accounting in Taxation cost?

Estimate the cost of your degree

How much does a Master of Science in Accounting in Taxation cost?

Expected Graduation

...

Approximate Total

...

*Student is required to take two courses per quarter during disbursement period

PREPARING YOUR RESULTS

Time commitment

Calculate the approximate time commitment of your degree.

| Course load | ... courses/term |

| Classroom time | ... hours/week |

| Terms per year | ... terms |

| Terms to graduation | ... terms |

Cost analysis

Calculate the approximate cost of your degree

| Tuition | ... |

| Books | ... |

| Fees | ... |

| No-cost gen ed | $0 |

| Transfer credits | ... |

| Transfer Credit Scholarship | $0 |

| $4K scholarship | $0 |

| Strayer Learn and Earn Scholarship | $0 |

| Approximate total | ... |

Ways to reduce tuition

$4K Alumni Master’s Scholarship

If you’re a Strayer University Alumni and ready to pursue a master’s degree, our Alumni Scholarship can save you $4,000. All you need to do is register for an eligible Strayer graduate program, maintain a GPA of 2.5 or greater and meet eligibility requirements.

50% off Master’s Scholarship

Enroll in two master’s courses, get 50% off tuition.

*Eligibility rules, restrictions and exclusions apply.

Civic and Community Alliance Scholarship

Ready to earn an affordable Strayer degree? Admitted Strayer or JWMI students who are employed in certain civic roles or volunteer for a nonprofit may be eligible to receive 25% off tuition for the duration of their program.

Explore courses in Strayer’s Master of Science in Accounting, Taxation

Navigate the intricate landscape of taxation by gaining essential skills in tax planning, research and preparation for individuals, proprietorships, corporations and partnerships. This concentration examines the complexities of the federal income tax structure and income tax accounting, along with an exploration of significant tax systems in Canada and other international regions.

Taxation Concentration Courses

Complete your degree from where you live, on your time, in a flexible, 100% online program. Using our online portal, you’ll be able to:

- Access lectures and coursework

- Complete assignments and exams

- Communicate with professors and classmates

- Access student resources and support

From day one, you’ll have a team of advisors and coaches to help you balance college, work and your personal life. Tap into support resources online or at a campus near you.

You’ll have access to:

- Admissions and enrollment support

- One-on-one academic coaches

- Financial guidance and potential cost savings

- Career planning services

The faculty at Strayer University bring years of real-world industry experience to the classroom, offering valuable insight and practical knowledge. They are committed to supporting your professional goals and are responsive to questions and concerns through the virtual courseroom.

Apply for your Taxation degree today

An admissions officer can help you choose the right program, register for classes, transfer credits and find cost-savings opportunities.

Here’s what you’ll need to get started:

Spring classes start on April 6

Learn more about Strayer University’s admissions process.

Transferring to Strayer from another university?

Transfer up to four eligible classes from a prior college or university to your master’s degree, saving time and money.

Strayer welcomes international students

Strayer University is proud to have hosted more than 4,000 international students from over 143 countries. Earn your degree in the U.S. or completely online in your home country – it’s your choice.

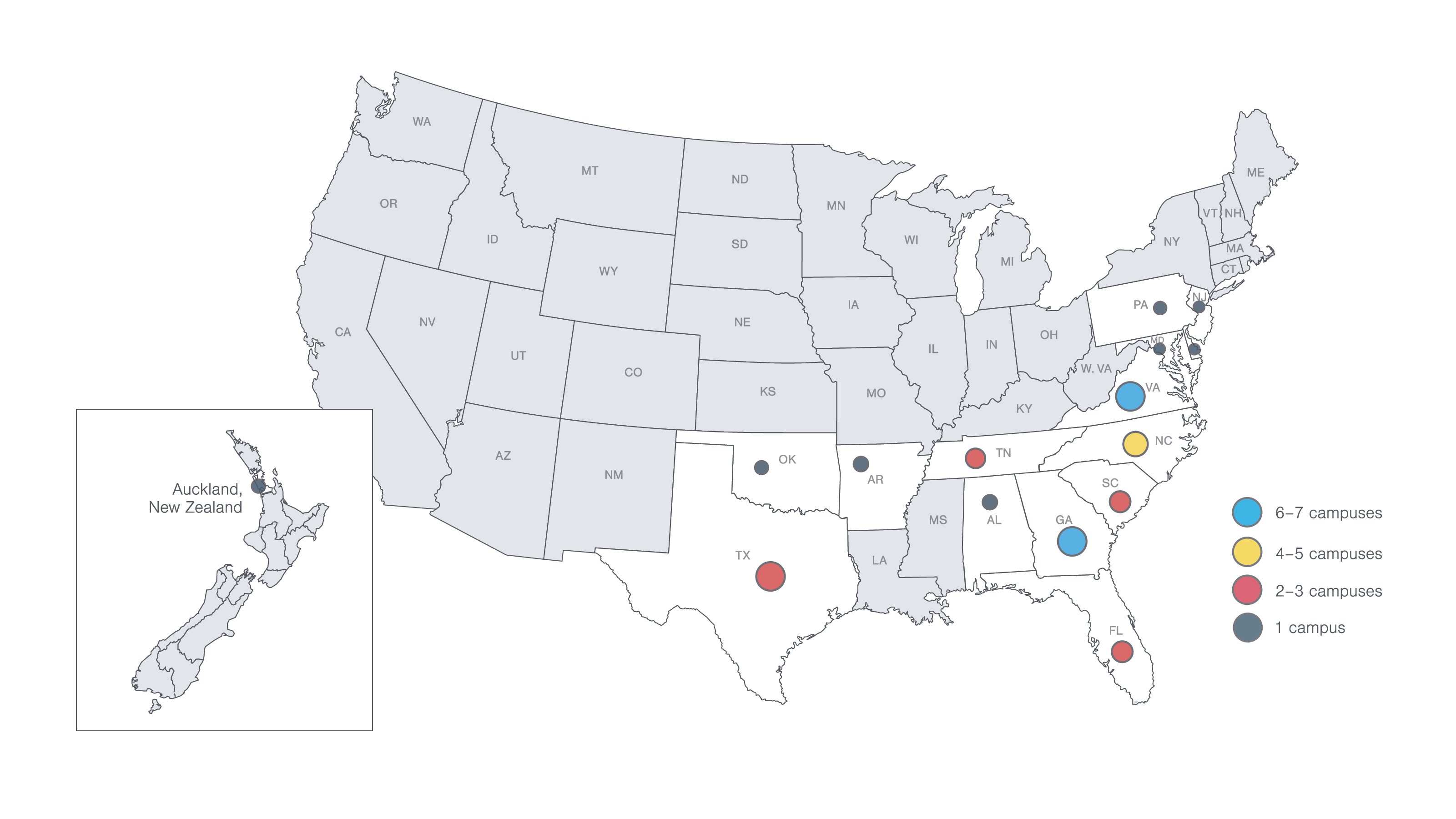

Campus locations

Come to a campus near you for guidance and support. You’ll have access to helpful resources, a supportive community and plenty of spaces to learn and grow.

Ready to take the next step?

Your admissions officer is here to guide you through every step of the process, from completing your application to choosing your concentration.