Master of Business Administration Finance

PROGRAM AT A GLANCE

12 master's courses

11 weeks long

$ 3045

Cost per course

Flexible learning

Online and in-person programs at select campuses, subject to availability

Why earn a degree in finance from Strayer?

Ready to take the next step in business? Elevate your skills with an MBA in Finance from Strayer University. This online program addresses complex financial management concepts and tools, detailing how these applications influence business performance in different markets.

Develop your skills for the finance sector

Want to help drive business success in global markets? Build your knowledge of financial principles and investment practices with an MBA in Finance from Strayer. You’ll explore the asset pricing models, portfolio management and analytical techniques needed to inform investment decision-making and other financial management strategies.

Skills you’ll learn in a Strayer MBA, Finance concentration

A Strayer degree can help prepare you for career opportunities in finance while offering support, flexible learning options and career planning every step of the way.

- Formulate financial management strategies for a firm’s operations in global markets.

- Evaluate capital investments and structure to minimize risks and maximize rewards for a firm.

- Apply analytical techniques and models to inform investment decisions.

Earn your degree from an accredited university

Strayer University is an accredited institution and a member of the Middle States Commission on Higher Education (MSCHE or the Commission) www.msche.org. Strayer University’s accreditation status is Accreditation Reaffirmed. The Commission’s most recent action on the institution’s accreditation status on June 22, 2017 was to reaffirm accreditation. MSCHE is recognized by the U.S. Secretary of Education to conduct accreditation and pre-accreditation (candidate status) activities for institutions of higher education including distance, correspondence education, and direct assessment programs offered at those institutions. The Commission’s geographic area of accrediting activities is throughout the United States.

Business Administration (Strayer) in Finance cost breakdown

- 12 courses, $3045 per course

- $65 technology fee each term

- $150 one-time degree conferral fee

- $100 resource kit per course

Estimate the cost of your degree

How much does a Business Administration (Strayer) in Finance cost?

Estimate the cost of your degree

How much does a Business Administration (Strayer) in Finance cost?

Expected Graduation

...

Approximate Total

...

*Student is required to take two courses per quarter during disbursement period

PREPARING YOUR RESULTS

Time commitment

Calculate the approximate time commitment of your degree.

| Course load | ... courses/term |

| Classroom time | ... hours/week |

| Terms per year | ... terms |

| Terms to graduation | ... terms |

Cost analysis

Calculate the approximate cost of your degree

| Tuition | ... |

| Books | ... |

| Fees | ... |

| No-cost gen ed | $0 |

| Transfer credits | ... |

| Transfer Credit Scholarship | $0 |

| $4K scholarship | $0 |

| Strayer Learn and Earn Scholarship | $0 |

| Approximate total | ... |

Ways to reduce tuition

$4K Alumni Master’s Scholarship

If you’re a Strayer University Alumni and ready to pursue a master’s degree, our Alumni Scholarship can save you $4,000. All you need to do is register for an eligible Strayer graduate program, maintain a GPA of 2.5 or greater and meet eligibility requirements.

50% off Master’s Scholarship

Enroll in two master’s courses, get 50% off tuition.

*Eligibility rules, restrictions and exclusions apply.

Civic and Community Alliance Scholarship

Ready to earn an affordable Strayer degree? Admitted Strayer or JWMI students who are employed in certain civic roles or volunteer for a nonprofit may be eligible to receive 25% off tuition for the duration of their program.

Explore courses in Strayer’s Master of Business Administration, Finance

Drive organizational goals by developing global financial management strategies. Our concentration examines international finance, advanced corporate finance and corporate investment analysis. You’ll learn how to evaluate capital investments to minimize risks and maximize rewards while applying analytical techniques and models to inform investment decisions.

Finance concentration courses

FIN 535 International Finance

FIN 540 Advanced Corporate Finance

FIN 550 Corporate Investment Analysis

Complete your degree from where you live, on your time, in a flexible, 100% online program. Using our online portal, you’ll be able to:

- Access lectures and coursework

- Complete assignments and exams

- Communicate with professors and classmates

- Access student resources and support

From day one, you’ll have a team of advisors and coaches to help you balance college, work and your personal life. Tap into support resources online or at a campus near you.

You’ll have access to:

- Admissions and enrollment support

- One-on-one academic coaches

- Financial guidance and potential cost savings

- Career planning services

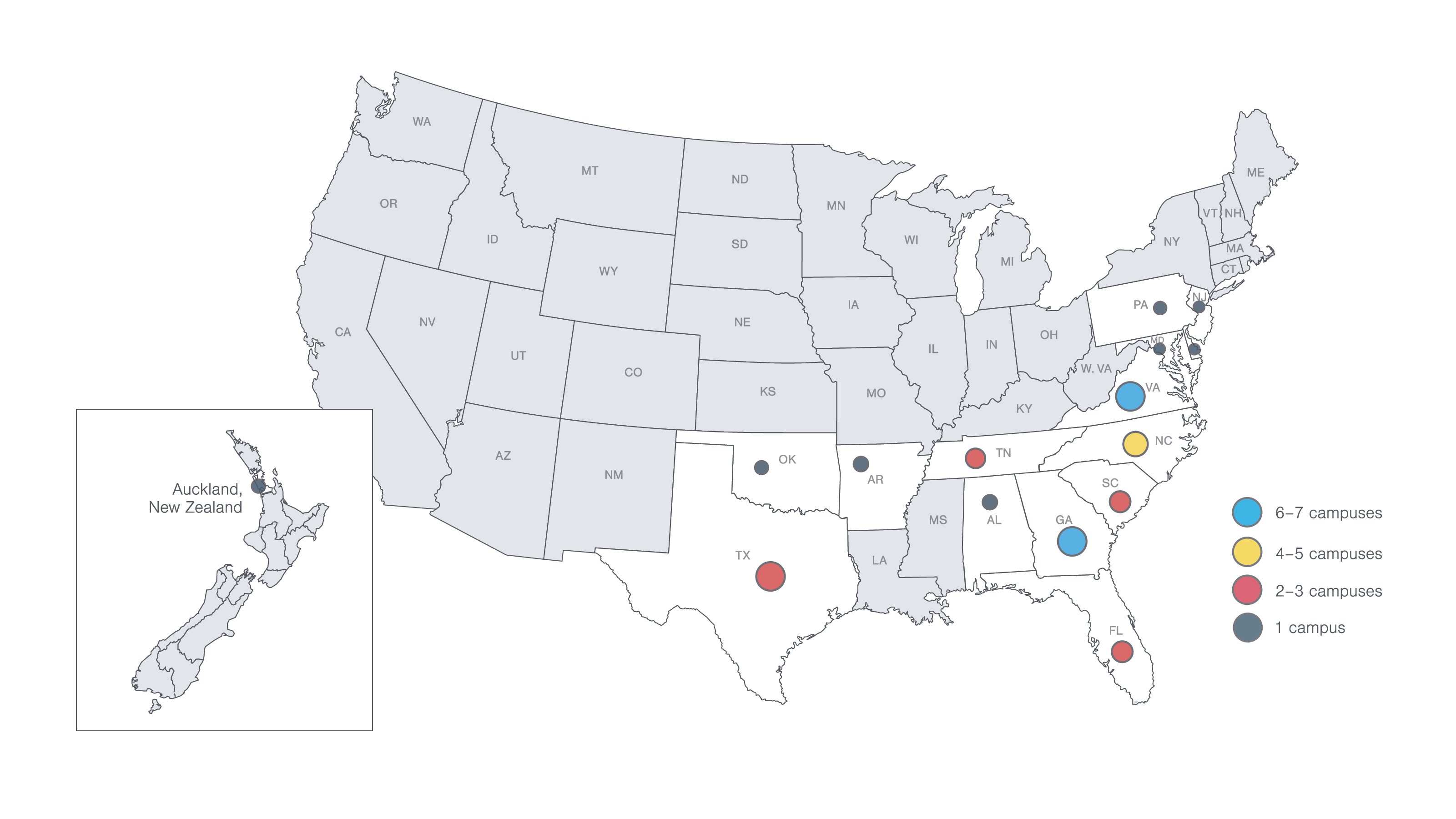

Strayer has many campuses where you can connect with your peers, chat with student coaches, access support resources and attend in-person hybrid classes (at select campuses only).

The faculty at Strayer University bring years of real-world industry experience to the classroom, offering valuable insight and practical knowledge. They are committed to supporting your professional goals and are responsive to questions and concerns through the virtual courseroom.

What can you do with an MBA in Finance?

Your education can help you pursue your professional and personal goals. While Strayer cannot guarantee that a graduate will secure any specific career outcome, such as a job title, promotion or salary increase, we encourage you to explore the potential impact you can have in the finance field.

Versatile skills for your future

The finance concentration provides students the knowledge to formulate financial management strategies for a firm’s operations in global markets. The elements of international finance, advanced corporate finance and corporate investment analysis are discussed. Students should be prepared to evaluate capital investments and structure to minimize risks and maximize rewards for a firm. Students will also be able to apply analytical techniques and models to inform investment decisions.

In addition, students who complete this concentration will be prepared to:

- Analyze information to determine how companies are doing financially and report on operations or risks to management.

- Analyze risks and investments to predict the impact they could have on companies.

- Build relationships to attract new business and assist customers with any issues they encounter.

- Connect with shareholders or investors to share important details or secure funding.

- Create financial or regulatory reports that are mandated by laws, regulations or boards of directors.

- Evaluate commercial, real estate and personal loans for approval or rejection.

- Manage employees working in branches, offices or departments of financial institutions like branch banks, brokerage firms or credit departments.

- Organize, oversee and manage risk and insurance programs for businesses.

- Plan budgets that are informed by financial data analysis.

- Review and recommend improvements for financial reporting systems, accounting or collection methods and investment practices.

Apply for your Finance degree today

An admissions officer can help you choose the right program, register for classes, transfer credits and find cost-savings opportunities.

Here’s what you’ll need to get started:

Spring classes start on April 6

Learn more about Strayer University’s admissions process.

Transferring to Strayer from another university?

Transfer up to four eligible classes from a prior college or university to your master’s degree, saving time and money.

Strayer welcomes international students

Strayer University is proud to have hosted more than 4,000 international students from over 143 countries. Earn your degree in the U.S. or completely online in your home country – it’s your choice.

Campus locations

Come to a campus near you for guidance and support. You’ll have access to helpful resources, a supportive community and plenty of spaces to learn and grow.

Ready to take the next step?

Your admissions officer is here to guide you through every step of the process, from completing your application to choosing your concentration.